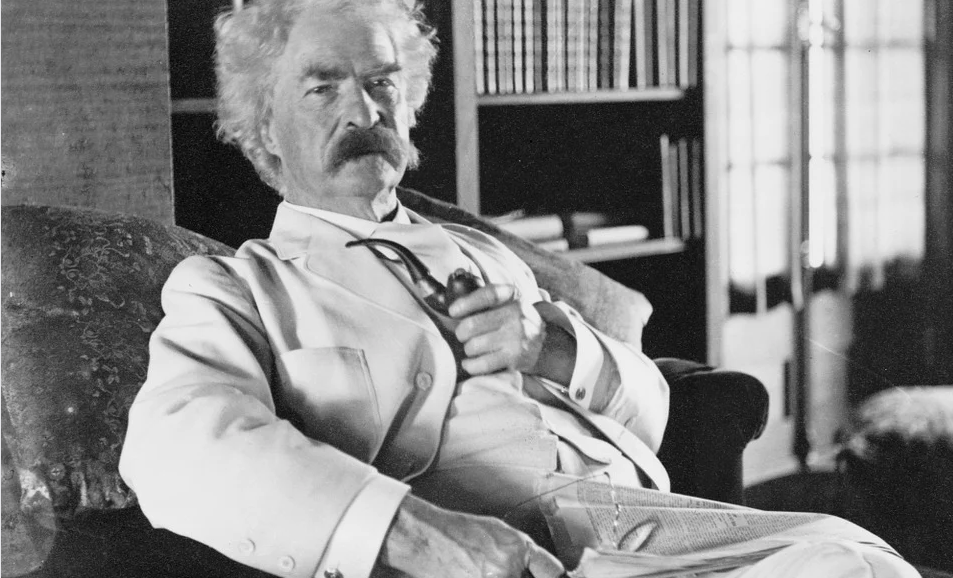

Like many people, I am a Mark Twain fan. Therefore, on a recent trip to Hartford, Connecticut I visited his historic home.

Browsing through the gift shop after the tour, the following book caught my eye, “Ignorance, Confidence, and Filthy Rich Friends: The Business Adventures of Mark Twain, Chronic Speculator and Entrepreneur” by Peter Krass. This book contains many useful personal finance insights, including the following:

First, and by way of background, Samuel Clemens, which is Mark Twain’s real name, was raised in poverty. One of the reasons why his family was poor is that his father went heavily into debt to speculate on land. The speculation was not successful and the family suffered financially as a result. This experience fostered in Sam Clemens a deep aversion to debt.

Nevertheless, Clemens went into debt to pursue certain commercial interests, which resulted in bankruptcy, and years of hard work to settle his debts. The perils of excessive debt are related to lessons that, unfortunately, need to be continuously learned by many different kinds of people.

Fortunately, Clemens developed a strong work ethic when he was young. He did not like being poor, and was determined to work hard to both create, and sustain, wealth. This he accomplished, and by so doing set an example that we should all seek to emulate.

However, like his father before him, Clemens was a speculative dreamer. While dreaming can help inspire great novels, it generally does not result in successful speculation.

For example, a number of speculations that Clemens ventured into were frauds. To make matters worse, Clemens exacerbated his losses by doing exactly what so many others have done: Throw good money after bad in the hope that doing so will “turn things around.” However, it never makes economic sense to continue to fund a fraud in the hopes of reversing one’s fortunes.

In both Clemens’s time, and our time, if someone is defrauded they should immediately contact the authorities, possibly with the assistance of legal counsel. While the law was far less complex In Clemens’s time, he nevertheless made extensive use of counsel to protect his legal rights, which is a practice that should be broadly followed.

Clemens finally came to see the folly of speculation as he famously observed, “There are two times in a man’s life when he should not speculate: when he can’t afford it, and when he can.”

Despite his incredible success as an author, Clemens tended to view himself as a businessman. Some of his businesses experienced success. For example, he started a firm that published the “Personal Memoirs of U.S. Grant.” This book was an international best-seller, and has become a classic of literature that is widely read to this day. Furthermore, the marketing strategy that Clemens implemented to promote Grant’s book was highly innovative, and continues to be studied.

However, despite all of this success, Clemens did not profit from publishing Grant’s memoirs. One of the reasons why pertains to the royalty agreement that he offered General Grant: While other publishers offered Grant a 10% royalty, Clemens offered Grant “an astounding 70%” royalty. Clearly, he was not price conscious and suffered professionally as a result.

In his later years, Clemens met and befriended a highly successful Standard Oil executive by the name of Henry “Hell Hound” Rogers. As his nickname betrays, Rogers was a no-nonsense executive who successfully advised Clemens on many business issues. While few of us have personal friends of such stature and capability, we can all make use of experts (such as financial advisors) to help inform our decision-making.

Despite his literary success, Mark Twain was bankrupt by the age of 59.

Written by Joseph Calandro, Jr. for the Center on Business and Poverty